How Much Does Car Registration Cost In Pennsylvania

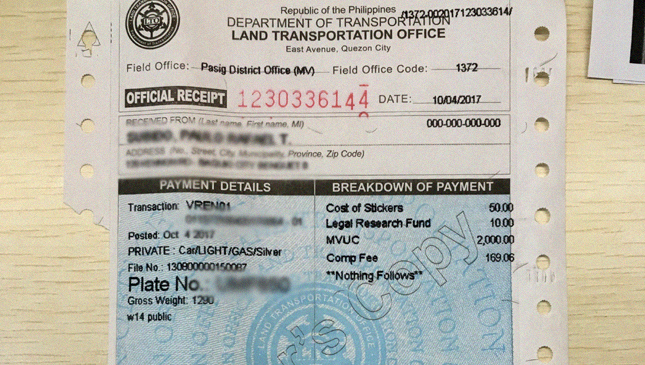

Annual Registration Fees. Many new car owners let their dealers handle the processing of their LTO car registration.

Standard Issue Registration Plate

For example a car made in 1970 or older and under 2700 pounds will cost 3550 as of July 1 2006 while a car made within the last two years and under 3500 pounds will cost 59.

How much does car registration cost in pennsylvania. But this of course comes with a price. As of May 2019 five states had variable costs based on either the MSRP or the age and weight of the vehicle. 51 rader Oregon has the highest registration fees in the US.

If it is a truck it will. How much does it cost to transfer a car title in PA. 37 for a one-year passenger car registration.

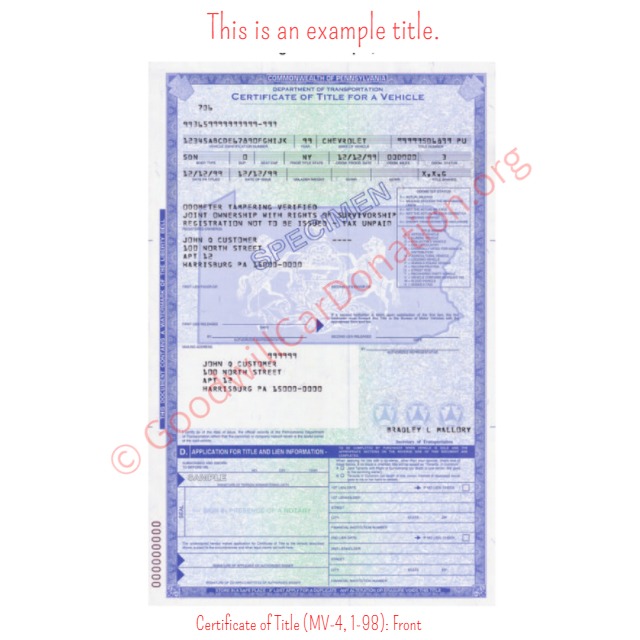

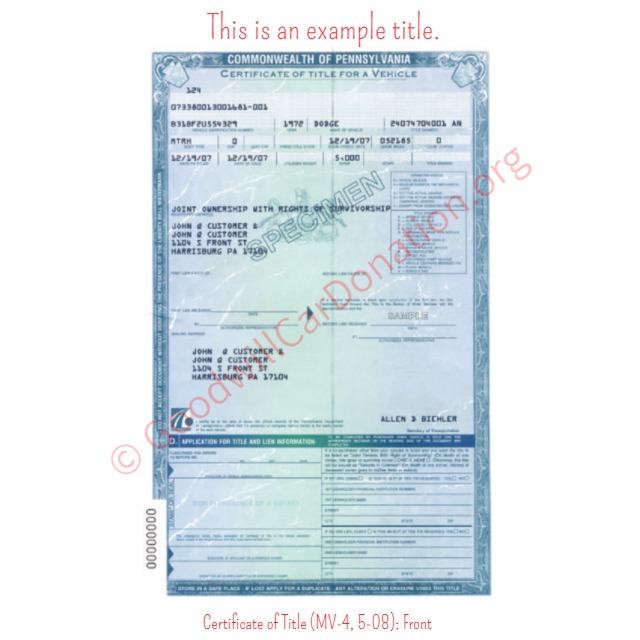

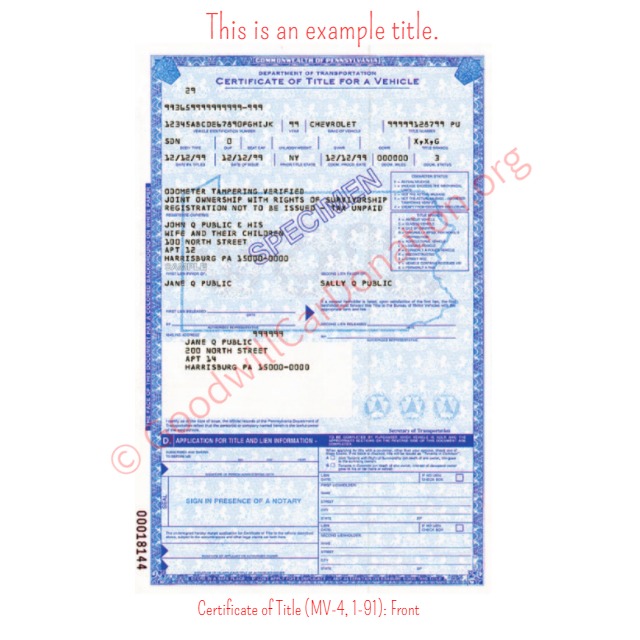

Motor Vehicle Registration Restoration. Pennsylvania requires a valid title or a manufacturers certificate of origin in order to transfer ownership of a car. All amendments are outlined below and include slight increases to various registration and title fees based on the Consumer Price Index.

Title transfer fees. Vehicle registration fees vary by vehicle type in Pennsylvania. The buyer will pay the 53 title transfer fee.

Once you register you car or other vehicle youll get a Pennsylvania license plate. Fee block on your registration renewal form is NA your vehicle type is not eligible to renew for a two-year period. Below are the steps on how to register your car with the LTO.

If you want to save money do the legwork and register your brand new car on your own. The cost to register your car depends upon the age and weight of the car with older and smaller cars less expensive than newer or larger ones. Salvor Reclaim Fee includes 25 to PD.

How To Transfer Ownership Of A Car Without A Title. The regular one-year passenger vehicle registration fee is 38. PA Title Transfer Fee.

52 rader Vehicle Registration Tax Insurance and Title Fees. Fees to Register Your Car. Some states have many optional or vanity plates which often include increased fees.

License plate fees structure vary. Specialty plate applications usually require additional forms and fees. The fees are broken down as follows.

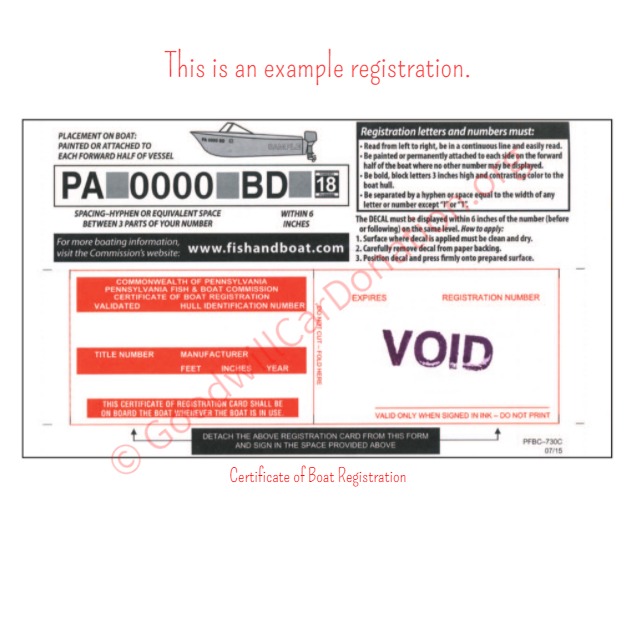

PennDOT issues a standard license plate as well as several types of special plates. The Pennsylvania Department of Transportation has amended many sections of Title 75 of Act 89 which was put in place for the purpose of increasing public safety driving commerce creating jobs and providing reliable funding for our transportation needs. Pennsylvania Car Registration Fees Vehicle owners need to pay a mandatory car registration fee which may vary based on the length of the registration.

Secure Power of Attorney Processing Fee. Motorcycles can be renewed for 2000 and Motor-Driven Cycles or Motorized Pedacycles cost 900 to renew. These fees are separate from the sales tax and will likely be collected by the Pennsylvania Department of Motor Vehicles and not the Pennsylvania Department of Revenue.

As of May 2019 the range for vehicle registration costs in the 45 states with a fixed cost was between 8 and 225. Additional fees apply for specialty registration plates. Registration fees include the cost of a standard registration plate for first time issuance.

Truck and Tractor registration renewal fees are determined based upon the weight of the vehicle and range from 6400 to 232600. Motor Vehicle Recovery Fund. These fees include the following.

If the fee listed in the 2-yr. Form MV-371 or MV-140 is required Farm Equipment Dealer - 37600 or one-half of the fee listed in the Regular TrucksTruck Tractor column whichever is greater. For common Passenger vehicles the registration renewal fee is 3800.

The method of calculating the amount of motor vehicle registration and title fees varies widely among states. Typically a title fee is a one-time fee assessed when the title is acquired by each owner. The cost for a title in those states ranged from 3 to 100.

Both registration periods and the required fees are provided on the registration renewal form or Form MV-70S Bureau of Motor Vehicles Schedule of Fees NOTE. 51 Registration Fee. Transfer of Registration Plate.

Between 26850 and 63650 for. Out of Service Order Restoration. The state of Pennsylvania issues license plates and registration cards not stickers.

LTO Car Registration Process for New Vehicles. Registration feesannual or biennial fees charged to motorists for each vehicle. The Pennsylvania Department of Transportation PennDOT charges the following fees for car title transfers and related transactions.

Processing Fee in lieu of Registration.

How To Sign Your Pennsylvania Title Goodwill Car Donations

How To Sign Your Pennsylvania Title Goodwill Car Donations

Register Title A Boat In Pennsylvania

This Could Be The Cost Of Car Registration With The Lto Next Year

Title Transfer In Pennslyvania Sell My Car Near Me Fast

Getting Your Vehicle Registered In Pennsylvania

Vehicle Services Titling Division Of Motor Vehicles

Title Transfer In Pennslyvania Sell My Car Near Me Fast

This Could Be The Cost Of Car Registration With The Lto Next Year

How To Sign Your Pennsylvania Title Goodwill Car Donations

What Is Pennsylvania Pa Sales Tax On Cars

How To Sign Your Pennsylvania Title Goodwill Car Donations

Pennsylvania Title Transfer Etags Vehicle Registration Title Services Driven By Technology

Vehicle Registration For Military Families Military Com

Can I Register A Car In A Different State Than I Live In Clearsurance

.jpg)

Post a Comment for "How Much Does Car Registration Cost In Pennsylvania"